The Customs Form Made Easy

Table of Content

Whether you want to send something as a private person or as a company: everyone knows the unpleasant situation of having to deal with the customs form (CN 22 or CN 23). But handling a customs shipment doesn't have to be that complicated! This article is intended to serve as a guide and simplify your life with regard to cross-border e-commerce and fulfillment

When do I have to include a customs form when shipping?

In general, the customs form must be enclosed with a consignment as soon as it's sent to a country outside the EU. For goods with a value of max. €377.22, the CN22 form is sufficient. For shipments exceeding this amount, the detailed CN23 form is required. For this reason, only the latter is described in detail in this blog and can also be used to complement the CN22. It is important to ensure that the form is attached to the outside of the shipping box. Ideally, the form should be enclosed in a transparent and self-adhesive sleeve. In addition, for goods sold, it is necessary to enclose a commercial invoice with a copy.

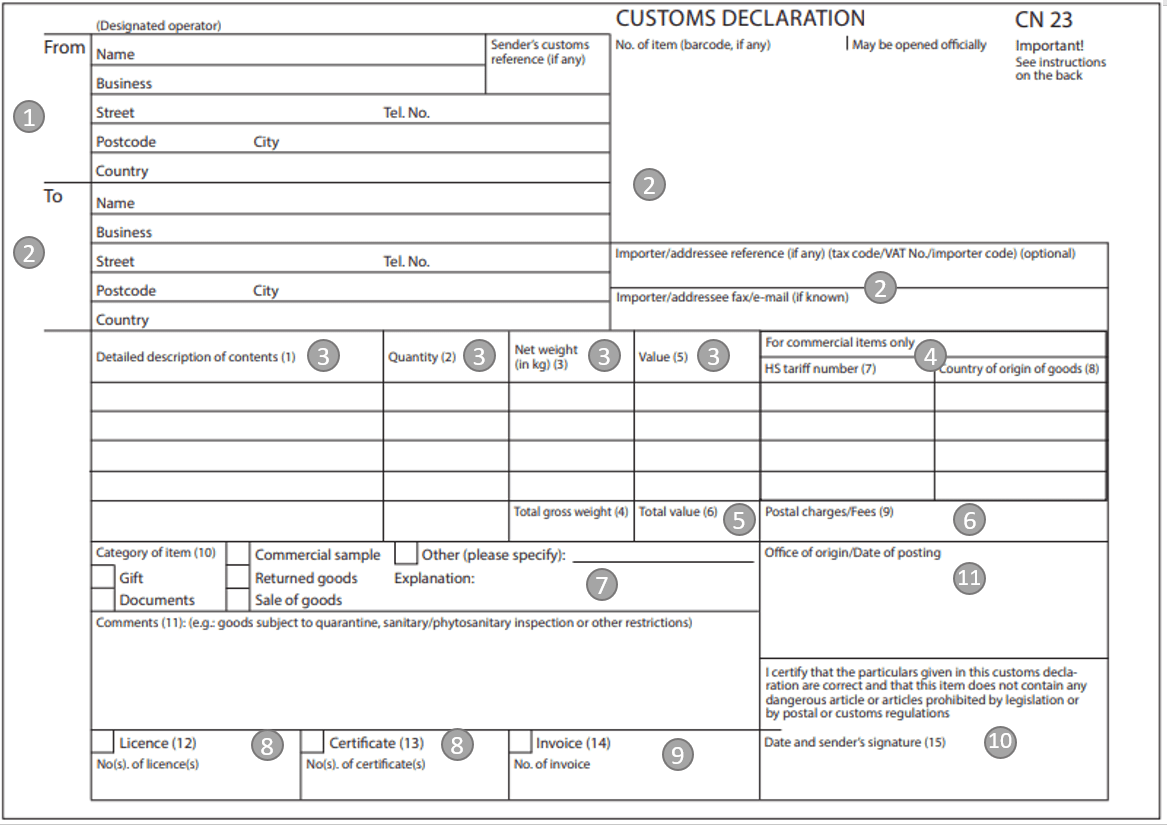

Fill in the customs declaration correctly - CN23 made easy

The most important thing is to make sure that the information is comprehensible to the officials in the receiving country. This means that it must be in English or in the respective national language. The fields on the customs form should be labeled as follows:

- Sender data:

- Recipient data: Enter the recipient's address again, even if it is already on the parcel label, and don't forget the country of destination. For commercial sales, the VAT ID must be listed to the right. It's advisable to add additional contact information below this.

- Quantity, description, weight, value, currency unit: Enter more detailed information about the goods you are sending. For similar items, add up the number, weight, and value of the goods.

- Customs tariff number and country of origin: This information doesn't have to be provided if it's a gift consignment, but is only mandatory for commercial goods. The customs tariff number corresponds to the HS code and is used to uniquely identify flows of goods. It's recorded in foreign trade statistics. A list of all customs tariff numbers can be found here: https://www.tariffnumber.com/ Country of origin means the country of manufacture of the goods in that case.

- Sum of the weight and the value of the goods: Total the cells filled in above. The total value of the goods should be the same as the enclosed commercial invoice (for commercial shipments).

- Postage costs: Customs duties in the recipient country are calculated on the basis of the value of the goods plus the postage costs (costs incurred exclusively for shipping). Therefore, indicate the postage costs in the currency of the destination country if the recipient is responsible for the shipping costs. If the delivery is free of shipping costs, this point is obsolete.

- Type of shipment: Tick as appropriate and state in the "Declaration", for example, that it's an "Article for sale".

- Remarks, certificates, approvals: This field must be filled in if you are sending goods requiring authorization to a non-EU country. This can be a complicated process and should be handled by experts.

- Invoice number: If you sell goods, a commercial invoice must be attached and the corresponding invoice number must be stated here.

- Date and signature of the sender

- Depository and date of dispatch: Will be taken over by the respective shipping company/post office.

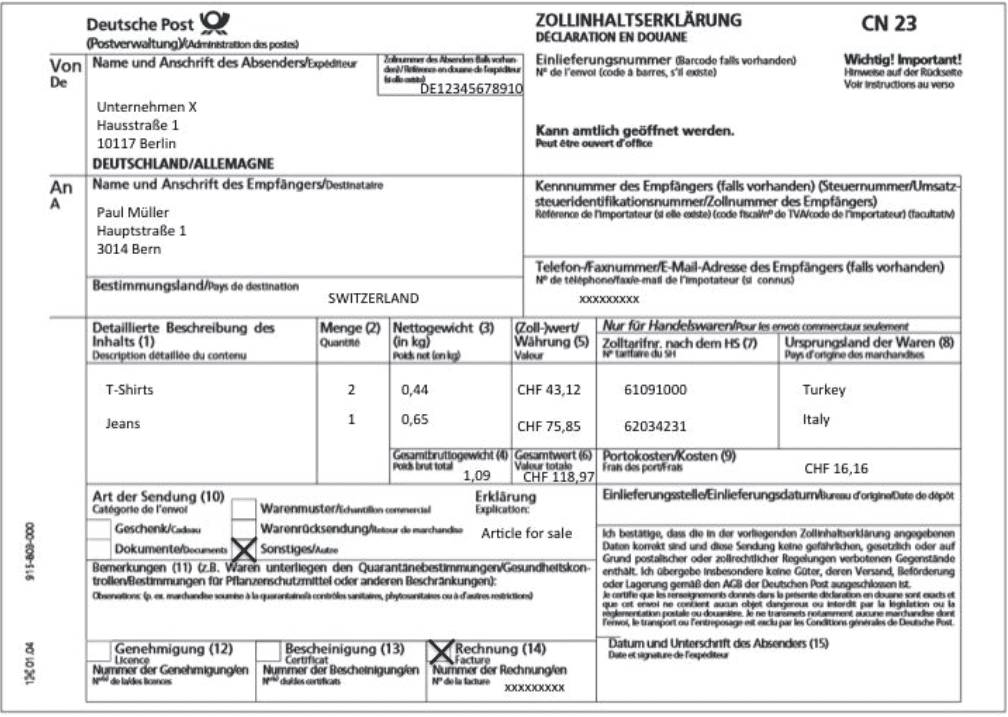

To clear up any remaining ambiguities, here is an example to make it easier to understand. Assuming you own an online shop and are sending two T-shirts (€19.90 each) and jeans (€70.00) to a third country (in this case Switzerland), the customs form would have to be filled out as follows:

With these instructions on how to process the customs form correctly, nothing should prevent you from sending your shipment to a third country!

Is the effort too tedious for you and do you want to get customs clearance over and done with quickly and easily? With the help of our app, you will be shown which data is required and asked for in detail. In addition to the shipping label, the customs form is automatically printed out in our warehouse and attached directly to the package so that there is no risk of confusion. In this way, we can ensure that you can provide the customs information within the shortest possible time and that your shipment really does reach the recipient!

You can find more information about our service here: getbyrd.com