The State of Amazon in Europe 2023

One company stands out above the others when it comes to controlling the European e-commerce market: Amazon. However, there are significant regional variations in Amazon's penetration of Europe's fragmented e-commerce sector.

In this blog post, we'll take a deep dive into Amazon's extraordinary journey in Europe, examining its development, successes, and competitors in each nation. We'll also reveal the most desirable European markets for Amazon vendors and sellers, along with the top product categories and market trends that will influence Amazon's retail environment in 2023.

Amazon in the UK

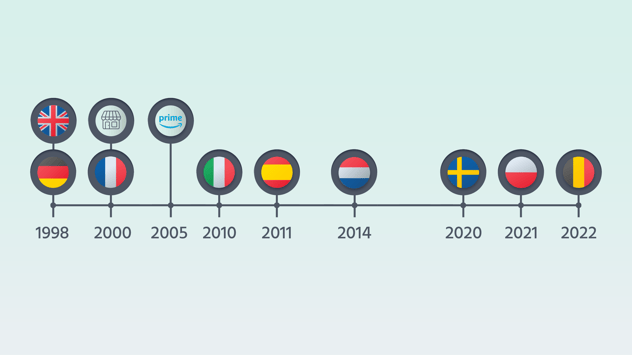

In 1998, Amazon began operations in the UK, originally selling solely books. The UK's first fulfilment centre was constructed in Marston Gate. When Amazon Prime was introduced in 2007, it provided consumers with free delivery, streaming services, and other perks. Amazon UK now has a number of fulfilment centres and a large selection of products.

Hard facts about Amazon UK

Visitors on amazon.co.uk in April 2023:

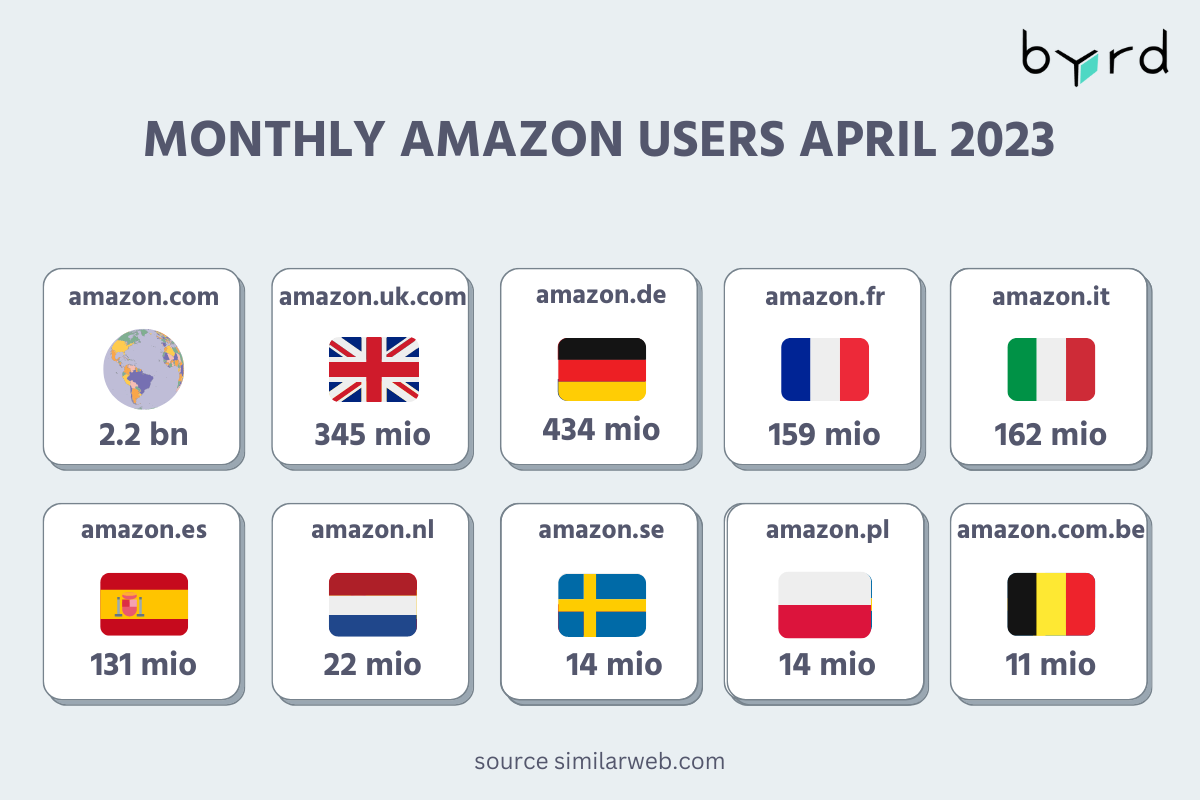

345.4 million

Amazon Revenue 2022 in the UK:

$30,074 billion

The 3 Biggest Amazon Competitors in the UK by monthly visitors:

- eBay

- Etsy

- Wayfair

Learn more about the UK's most popular online marketplaces.

Amazon in Germany

In 1998, Amazon launched its business in Germany and initially focused only on selling books. They established their first fulfilment centre in Regensburg. Amazon Prime was launched in 2007, a revolutionary service that provided consumers with free delivery, streaming services, and a plethora of additional advantages. Today, Amazon Germany has a number of cutting-edge fulfilment centres and provides a vast selection of products to meet the demands of every type of customers.

Hard facts about Amazon Germany

Visitors on amazon.de in April 2023:

433.6 million

Amazon Revenue 2022 in Germany::

$33.6 billion

The top 3 Amazon rivals in Germany according to monthly visits are:

- eBay

- Otto market

- Zalando

Find out more about Germany's most popular marketplaces.

Amazon in France

When Amazon came to France in 2000, they brought with them a wide selection of books, music, videos, and DVDs for customers to explore. The first fulfilment centre for Amazon in France was established in Orleans, signalling the first step in the company's successful existence in France. Today, Amazon France has several strategically placed fulfilment centres spread out around the nation, enabling them to provide a wide range of products that appeal to various client tastes.

Hard facts about Amazon France

Visitors on amazon.fr in April 2023:

159.1 million

Amazon Revenue 2022 in France:

$5.4 billion

The top 3 Amazon rivals in France based on monthly visitors are:

- Cdiscount

- eBay

- AliExpress

Find out more about the most popular marketplaces in France

Amazon in Italy

2010 marked Amazon's entry into Italy, and in 2011 their first fulfilment centre, which was situated in Piacenza, began its operations. Today, Amazon Italy runs a number of fulfilment centres and provides a wide range of products to meet the needs and tastes of a wide spectrum of customers.

Hard facts about Amazon Italy

Visitors on amazon.it in April 2023:

162.3 million

Amazon Revenue 2022 in Italy:

$5.28 billion

The top 3 Amazon competitors in Italy according to monthly visitors are:

- eBay

- Subito

- Zalando

Learn more about the most popular marketplaces in Italy

Amazon in Spain

Amazon started its journey in Spain in 2011. A year later, in 2012, the first fulfilment centre began to take shape in San Fernando de Henares, Madrid. Currently, Amazon Spain is thriving thanks to its several fulfilment centres that have been carefully positioned throughout the nation, assuring a wide selection of products that meet the various preferences and demands of customers.

Hard facts about Amazon Spain

Visitors on amazon.es in April 2023:

131.1 million

Amazon Revenue 2022 in Spain:

$5.55 billion

The top 3 Amazon competitors in Spain according to monthly visitors are:

- El Cortes Inglés

- Carrefour

- Pccomponentes

Learn more about the most popular marketplaces in Spain.

Amazon in the Netherlands

In 2014 Amazon's entered the Dutch market. Amazon Netherlands does not currently have a fulfilment centre of its own. Instead, to fulfil consumer requests and guarantee prompt delivery, goods are sent from nearby nations like Germany and France. Amazon Netherlands aims to provide customers throughout the nation with a large selection of products and easy shopping experiences despite the lack of a local centre.

Hard facts about Amazon Netherlands

Visitors on amazon.nl in April 2023:

21.5 million

Amazon Revenue 2022 in the Netherlands:

$809 million

The top three Amazon competitors in the Netherlands based on monthly visitors are:

- Bol.com

- Marktplaats.nl

- Zalando

Learn more about the most popular marketplaces in the Netherlands.

Amazon in Sweden

Amazon made its entrance in Sweden in 2020, bringing with it a whopping 30 categories of goods. Although Amazon Sweden doesn't yet have a warehouse of its own, one is on the way. This planned warehouse, which will be situated in Eskilstuna, close to Stockholm, will soon improve Amazon's operations by assuring effective product storage and distribution to better serve customers throughout Sweden.

Hard facts about Amazon Sweden

Visitors on amazon.se in April 2023:

13.9 million

Amazon Revenue 2022 in the Netherlands:

$117 million

The 3 Biggest Amazon Competitors in the Netherlands by monthly visitors::

- Clas Ohlson

- Aliexpress

- eBay

Amazon in Poland

In 2021, Amazon launched its marketplace in Poland, introducing 30 diverse product categories. Despite the recent debut, Amazon has had a fulfilment centre in Sady, close to Poznan, since 2014. These initiatives have helped Amazon expand its presence in Poland and provide clients a variety of choices and practical services.

Fun fact: Warsaw played a crucial role globally by introducing Alexa's voice capabilities.

Hard facts about Amazon Poland

Visitors on amazon.pl in April 2023:

13.7 million

Amazon Revenue 2022 in Poland:

$225.6 million

The 3 Biggest Amazon Competitors in Poland by monthly visitors::

- Allegro.pl

- Olx.pl

- Aliexpress

Amazon in Belgium

Amazon entered the Belgian market in 2022. Their initial fulfilment centre was established in Antwerp, which enabled effective operations. It's interesting to note that the domain name "amazon.be" is currently linked to an insurance provider; as a result, Belgium's Amazon domain is amazon.com.be.

Hard facts about Amazon Belgium

Visitors on amazon.be.com in April 2023:

10.9 million

Amazon Revenue 2022 in Belgium:

$53 million

The top 3 Amazon competitors in Belgium according to monthly visitors are::

- Bol.com

- Coolblue.be

- Aliexpress

The Most Attractive European Markets for Amazon Sellers and Vendors

Iconic Sales' research indicates that price levels per market, even within Europe, exhibit some discernible variances. In order to do that, they looked at the top 10 selling items in Germany and contrasted the costs in the five most important European nations.

This suggests that, in terms of price ranges, the Spanish market is the best place to sell. The 10 items cost 145€ more in Italy (3149€) than in Germany. The UK have the second-highest price. The average cost of the 10 reviewed products is exceeded by 9 of them. Italy (3050€) and France (3120€) are ranked third and fourth, respectively.

Despite not being on that list, it is important to note that both the Dutch and Belgian markets are gaining momentum and have higher price levels than the national average.

.png?width=1200&height=800&name=Costs%20level%20on%20Amazon%20in%20Europe%20(1).png)

Top Product Categories in Amazon 2023 Globally

The two most obvious ways for a seller or vendor to grow their business are by diversifying their product offerings or by expanding their geographic reach. It's important to keep updated and on top of trends, especially for the latter. Check out the top product categories for 2023 and the hot items on Amazon this year compared to last, according to a report from Jungle Scout.

The 10 most popular product categories on Amazon 2023

- Home & Kitchen (35%)

- Beauty & Personal Care (26%)

- Clothing, Shoes & Jewelry (20%)

- Toys & Games (18%)

- Health, Household & Baby Care (17%)

- Baby (16%)

- Electronics (16%)

- Sports & Outdoors (16%)

- Art, Crafts & Sewing (14%)

- Books (13%)

The 10 most trending product categories on Amazon 2023

- Appliances (+4%)

- Home & Kitchen (+3%)

- Beauty & Personal Care (+3%)

- Grocery & Gourmet Food (+3%)

- Clothing, Shoes & Jewelry (+2%)

- Baby (+2%)

- Electronics (+2%)

- Cell Phones & Accessories (+2%)

- Apps & Games (+2%)

- Multiple other (+1%)

Product categories on Amazon that have declined

Only four categories decreased. These are:

- Toy and games (-2%)

- Arts, Crafts & Sewing (-1%)

- Books (-1%)

- Garden & Outdoor (-1%)

Product categories on Amazon that did not change

In total, eight categories stayed the same:

- Health, Household & Baby Care

- Sports & Outdoors

- Pet Supplies

- Tools & Home Improvement

- Handmade

- Industrial & Scientific

- Video Games

- Musical Instruments

Summary of the State of Amazon in Europe

The e-commerce market in Europe is diverse, and Amazon's market share differs by region. Among the nations where Amazon operates include the UK, Germany, France, Italy, Spain, the Netherlands, Poland, Sweden, Poland, and Belgium.

Vendors and sellers should think about product diversity and geographic expansion in order to flourish in the European marketplaces. It is critical to consider both the trends for those categories as well as the most well-liked product categories on Amazon in 2023.

FBM and SFP alternatives are the best bet for merchants looking to increase their presence on Amazon while establishing a strong brand. Amazon merchants can outsource logistics, increase their sales channels, and develop a strong brand by using byrd's FBM fulfilment and SFP fulfilment services. Contact byrd today!