The End of the Duty-free Allowance in the EU

Table of Content

Shipments from outside the EU are currently free of import duties up to a total value of €22 (up to €45 for private gift shipments). The reason for this is the so-called duty-free allowance. What was initially announced for the beginning of 2021 will now actually be implemented on July 1, 2021 - the duty-free allowance will be abolished at the beginning of the second half of 2021.

Elimination of the duty-free allowance and its implications for e-commerce dropshipping businesses

For companies whose business model is based on dropshipping, for example, shipping products from Asia, these changes have serious consequences. The costs for most products will increase by about 20%, depending on the destination country.

In addition, the recipients themselves are responsible for providing the correct information. They must therefore be able to show invoices and transaction confirmations if asked for. Any inspections by customs will therefore lead to delays in shipping, which will result in longer waiting times and subsequently have a negative impact on customer satisfaction. Moreover, extended storage times result in increased storage costs for parcel delivery companies, which will be passed on to the online sellers. For these reasons, many e-commerce dropshipping companies are looking for alternative solutions, such as using the services of fulfillment service providers. More on this below.

Why will the duty-free allowance be abolished?

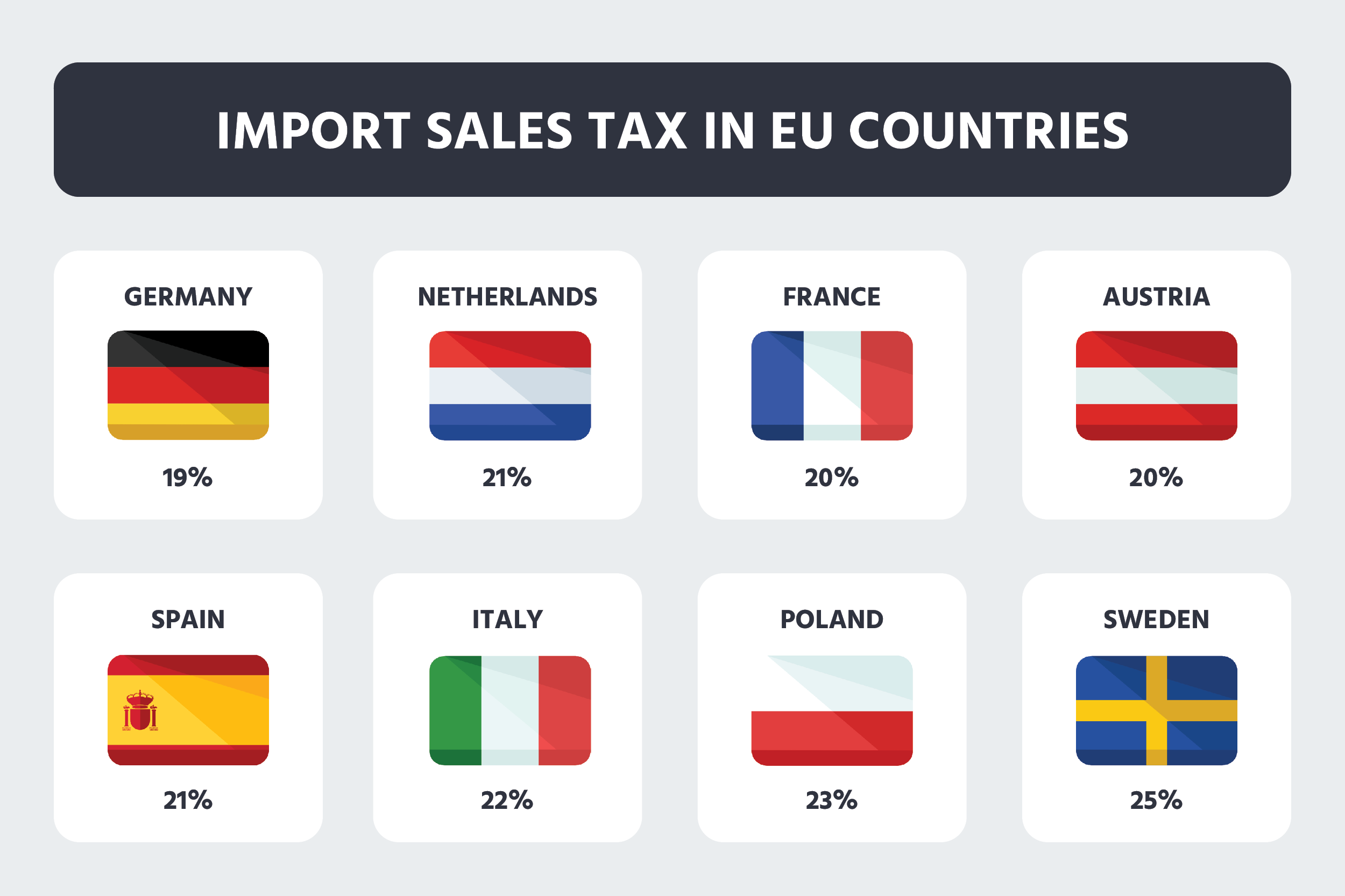

The abolition of the duty-free allowance on 01.07.2021 is primarily intended to curb VAT fraud. In addition, this means that online retailers and dropshippers from outside the EU will no longer be given preferential tax treatment. For example, before the new regulation, a retailer did not have to pay any duties when buying headphones for €19.99 from China. But a German e-commerce company had to pay 19% tax when selling the same product at the same price. French and Austrian online merchants would have to pay 20% and Spanish (21%), Dutch (21%), Italian (22%), Polish (23%), and Swedish (25%) even more than that. This will soon be a thing of the past. In addition to increased fairness, this of course also means additional revenue for EU countries (in Austria alone, an additional €150 million in tax revenue is expected to be generated - bigger countries will generate significantly more than that).

Do I have to pay import taxes for any amount from July onwards?

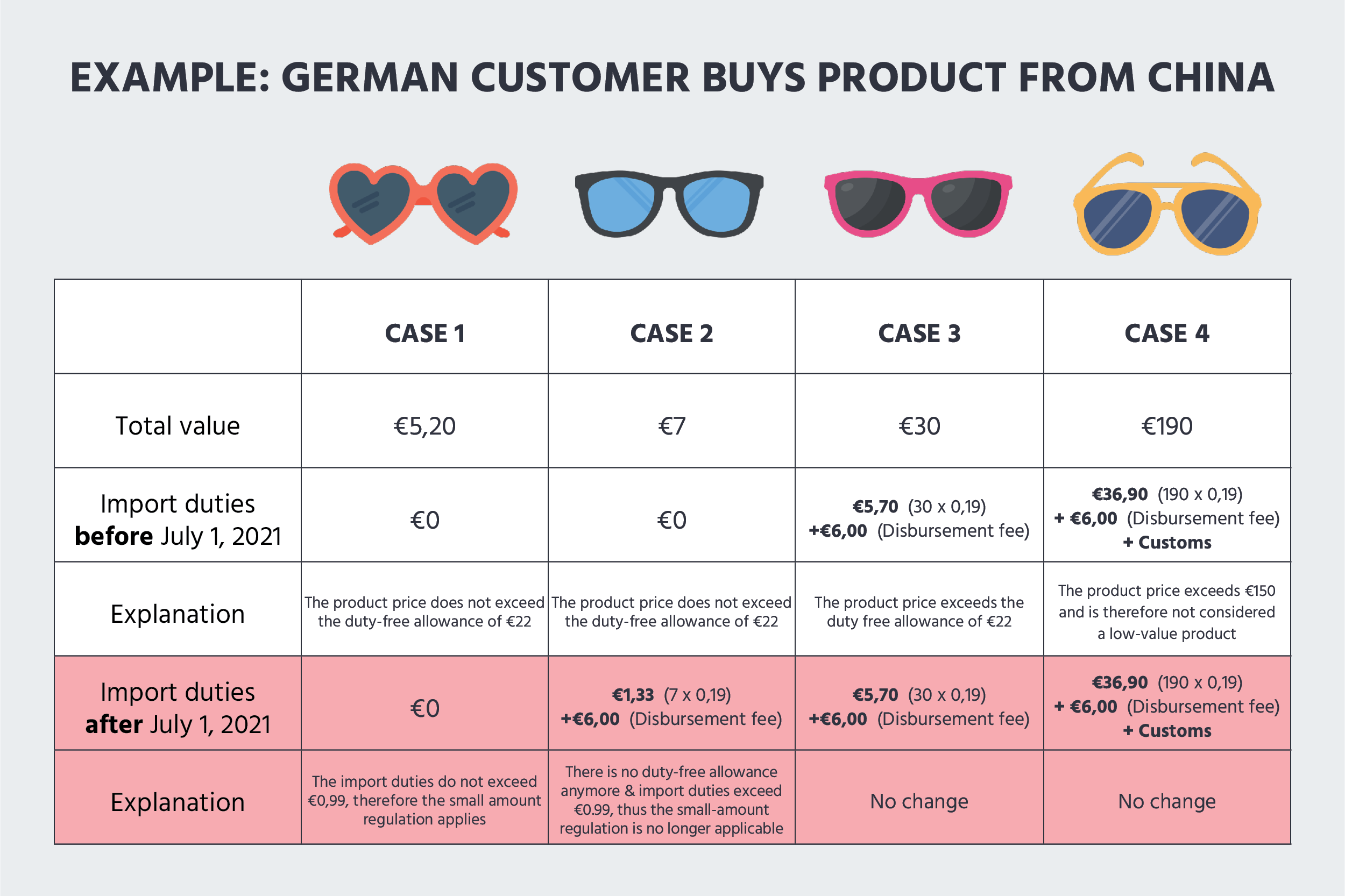

No, not necessarily. Although the duty-free allowance will be suspended in July, you can still, in some cases, import goods without paying import VAT. If the customs payment (import VAT) would total to less than 1€, you’re exempt from paying the customs. This is covered by the so-called small-amount regulation up to €1. So, for example, if you import goods to Germany from a country outside of the EU, with a total value up to 5.20€ (with 19% import VAT in Germany), you are exempt from paying import tax as the import tax would amount to less than €1.

Let's take a closer look at this using four examples:

Case 1:

Imagine you buy affordable new pair of sunglasses from an online retailer from outside of the EU. The price you paid for the sunglasses was 5.20€, so due to abolished duty-free allowance, an import tax of 19% (if you reside in Germany) is due. This amounts to a tax charge of 99 cents, however, because the import duty is less than 1€, the small-amount regulation applies and the duty is not applicable.

Case 2:

If you buy the sunglasses after 1. 7. 2021, for example, at a price of 7€, the small amount regulation becomes invalid. This is because the import duty tax would amount to 1.33€, exceeding the threshold limit by 33 cents. In this case, you (as a customer) must pay the German import VAT of 19%, and the shipping service provider (Deutsche Post, DHL, or alike) will collect this charge plus a 6€ flat rate disbursement fee.

A disbursement fee is charged by shipping service providers for all parcels that are delivered from non-EU countries to the customer’s door. However, there are ways to get around this avoid unnecessary extra charges. More about this here.

Case 3:

In this case, the customer buys a pair of sunglasses for a total price of €30. This amount exceeds the duty-free allowance of €22, therefore, duties of €5.70 (30 x 0,19) are due both before and after the new regulations for import into the EU come into force. In addition, the flat rate disbursement fee has to be paid as well.

Case 4:

You decide to buy a pair of branded sunglasses worth €190. Thus, the order exceeds a total value of €150 and is therefore no longer considered a low-value shipment. This in turn means that in addition to VAT (e.g. €190 x 19% = 36.10€) and the disbursement fee, a certain percentage of the value of the purchase price must also be paid as customs. As usual, the purchase price includes the shipping costs. The amount of the percentage depends on the product category - some goods are even imported free.

When does the abolition of the duty-free allowance come into force?

The new regulations come into force at 0:00 on July 1, 2021. Dropshippers and traders from other EU countries beware! There will be no transition period for this change. So, if you send your products from China in June, but they arrive in the EU in July, they are already taxable.

Fulfillment provider as a solution for e-commerce dropshippers

In addition to the increased costs, customers that buy goods from dropshippers and e-commerce companies importing goods from outside the EU will now also experience increased hassle and longer waiting times as a result of the new import regulations. This leads to dissatisfaction among online buyers and will have a huge impact on the buying experience. At the same time, however, there is an opportunity for commercial success for those online retailers who prepared accordingly. In this regard, we see that a large number of online retailers are increasingly relying on the services of 3PL partners and fulfillment service providers. This move seems strategically reasonable for the following reasons:

- Customs clearance can be handled in advance in large quantities

- Delays at the border are prevented

- Overall less effort in handling goods

- Goods can be stored in warehouses in target markets

- Delivery routes are shortened significantly

- Faster shipping

- Lower costs

- A more environmentally friendly solution

- No unpleasant surprises for customers in the form of disbursement fees

Therefore, if you place a high value on your customers' satisfaction and you want a fast and reliable delivery, while keeping the costs as low as possible, the services of fulfillment partners like byrd could be a perfect solution for you.

Duty-free allowances in Switzerland

Incidentally, Switzerland is one step ahead of the EU when it comes to duty-free allowances. They were already suspended at the beginning of 2019. Since then, every online retailer has had to pay VAT. There are also no exceptions for very small quantities. Previously, the free customs limits were 65 or 200 Swiss francs, depending on the product (currency exchange rate 24.03.2021, 1 CHF = €0.90).

What this example has shown, and what the EU should learn from, is that it is especially large companies, such as Aliexpress or Wish, that have found ways to circumvent the new regulations. In fact, according to a report by Blick.ch, none of these companies are on the list of taxable e-commerce companies.

For every e-commerce and dropshipping company smaller than these leviathans, it is of utmost importance to find solutions to keep customers satisfied and margins stable. Check out byrd for more information on how we can help you with that challenge.