Cross-border e-commerce: Succeed with cross border warehousing and fulfillment

Table of Content

Cross-border e-commerce in Europe has seen remarkable growth in recent years. In 2023, 7 out of 10 European internet users made online purchases. As technology advances and digital infrastructure in supply chains improves, cross-border e-commerce is becoming increasingly seamless and appealing to both retailers and consumers. However, the success of cross-border e-commerce hinges on several critical factors, including effective marketing strategies, legal compliance, and, most importantly, optimized logistics.

This article focuses on logistics, a key driver of success in online commerce. In 2024 and 2025, shipping costs and delivery efficiency remain major challenges for e-commerce businesses. To address these issues, retailers are increasingly adopting strategies like using international fulfillment warehouses. These decentralized storage solutions help reduce shipping costs and delivery times by positioning goods closer to customers, providing a competitive edge in both cost and speed. Keep reading to learn more!

Cross-border Warehousing in E-commerce

When expanding into new countries, online merchants encounter difficulties in cross-border shipping. These disadvantages become particularly apparent when compared to local competitors, who can offer faster and cheaper shipping options. To stay competitive, e-commerce companies must develop an effective fulfillment strategy, such as using local fulfillment centers in the target market. This approach helps minimize delivery times and shipping costs, allowing merchants to compete more effectively with local businesses.

A popular solution is the decentralized storage of goods in various fulfillment centers. It is no coincidence that online merchants with a strong logistics network are among the most successful companies in e-commerce. Amazon, Zalando & Co. have realized early on that shipping to the end customer can be a competitive advantage and therefore they invest millions each year in the expansion of their logistics networks.

Today, businesses can store goods in multiple countries without the need for heavy investments in logistics infrastructure. Fulfillment providers like byrd offer solutions by operating warehouses in key European markets across Germany, Spain, Italy, France, the UK and Austria. By using these strategically located fulfillment centers, merchants can store products closer to their customers, reducing both delivery times and shipping costs. The following section explains why this is so important and what you have to pay attention to when internationalizing your logistics.

Optimize Shipping Costs and Delivery Times Through International Warehousing

Shipping costs have almost become a no-go for web shoppers. A study by DHL shows that 41% of Internet shoppers are discouraged from placing international orders due to high shipping fees, while 48% are increasingly concerned about extended delivery times. As a result, online retailers are often compelled to absorb the shipping costs for the buyer and therefore have to include them in the product price.

However, at the same time, you don't want to discourage potential customers with high prices and have to look for ways to minimize shipping costs. By storing the goods in a fulfillment center in the destination country, you can achieve exactly that and reduce the delivery time as well.

Take Local Preferences Into Account For Cross-Border E-commerce

By cooperating with a suitable fulfillment service provider in different countries, online retailers can also benefit from the country-specific expertise of these partners. These provider possess valuable local customer preferences about delivery options. For example, many Scandinavian and French consumers favor having their parcels delivered to designated parcel shops instead of their home addresses.

You can find detailed information about the most popular parcel shipping companies in the UK, and the leading parcel shipping providers in the Netherlands, Germany, and France. Each region has specific delivery preferences and standards, particularly regarding shipment tracking options, which are important for satisfying local customers.

Additionally, it's crucial to be aware of which local parcel service providers are recognized for their quality and reliability, as these are often preferred by consumers. According to a DHL Express study, many online merchants identify the reliability of shipping partners as one of the biggest challenges in international logistics. This highlights the need for carefully choosing logistics providers to ensure a smooth and dependable cross-border e-commerce operation.

Simplify Returns Management

Simple return shipping plays an important role in online shopping. According to a DHL report, return costs and complicated return processes are key factors that lead online shoppers to abandon their carts. To enhance customer satisfaction, it's essential to be transparent about any potential return procedures and associated costs. This approach not only builds trust with customers but also reduces cart abandonment rates. A user-friendly return process can significantly influence a customer's decision to buy.

When Does Cross-border Warehousing Pay Off for Online Merchants?

As you can imagine, there is no general answer, but certain criteria that can be taken into account when making a decision. Especially from a logistical perspective, the number of storage units, also called SKU (Stock Keeping Units), plays an important role in cross-border e-commerce here. With numerous SKUs (e.g. more than 5,000) and for example 1,000 shipments in the destination country, a local warehouse will not be worthwhile for online merchants.

With increasing shipping volumes and correspondingly greater savings potential in shipping costs, dispatching orders from a fulfillment center abroad is becoming more and more attractive. However, this also depends on the products and the current shipping prices.

One strategy for successfully entering another target market with your online shop is to reduce the number of SKUs. Only those products with particularly high demand are stored in the fulfillment center abroad, to expand the product range step by step.

Cross-border Warehouse Use in E-commerce: Tax Aspects Within The European Union

When shipping products from different countries within the European Union, online merchants face various challenges. Questions often arise, particularly about the tax aspects that need to be taken into account. Here, we have summarized the most important points you need to consider.

Tax Registration Abroad For E-commerce Businesses

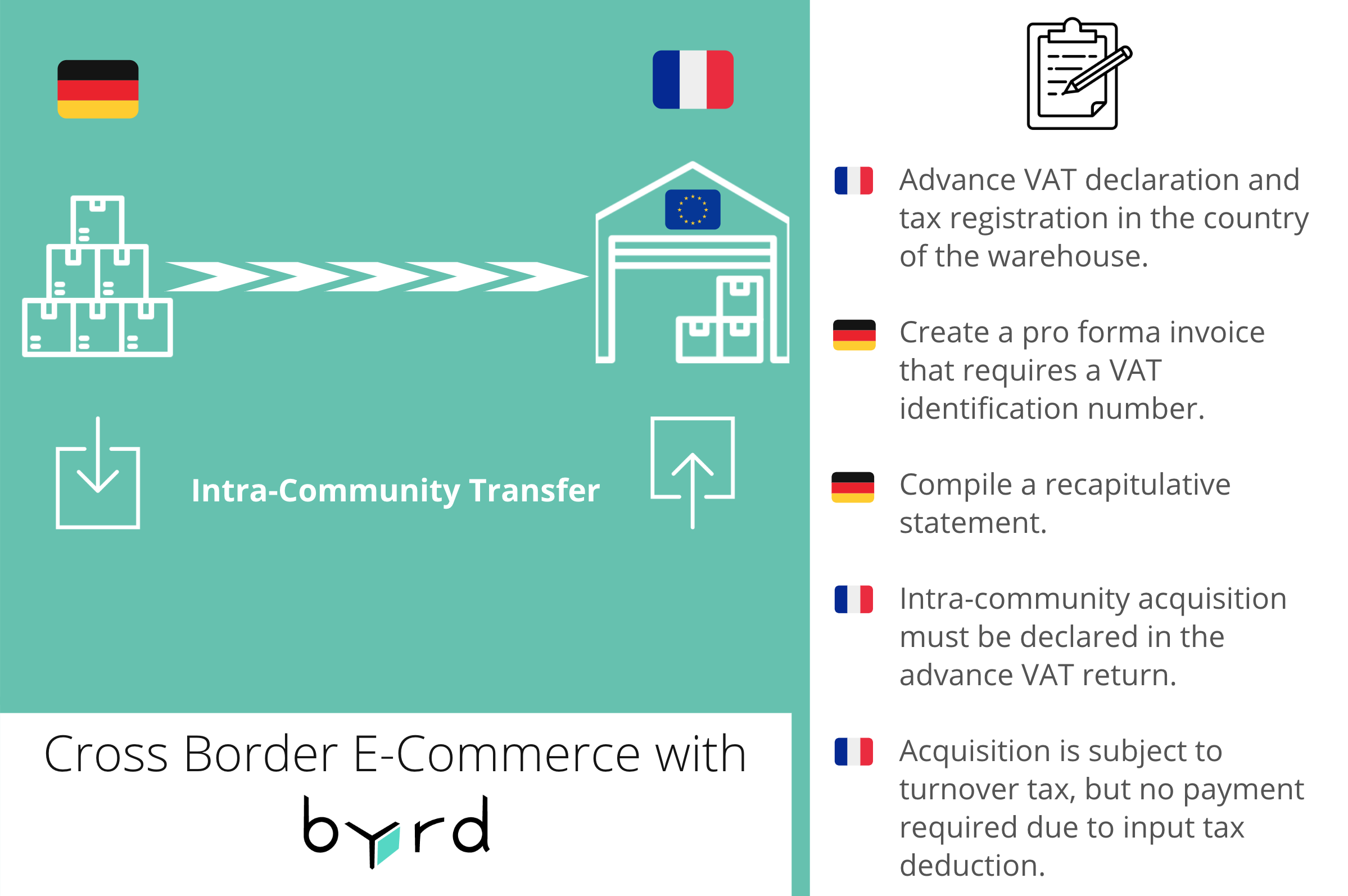

From the first product that you ship to a foreign warehouse within the EU, you must register for tax in the respective destination country and complete an advanced VAT declaration. In many cases, other obligations are added to this, but these depend on the regulations in the respective country.

Intra-Community Stock Transfer

The shipment of the goods to your foreign warehouse in the European Union is referred to as an Intra-Community transfer and is reported in the country in which the delivery starts. This is relevant from a sales tax point of view, as the EU documents the flow of goods within the Union to curb tax evasion - Intra-community transfers, however, are tax-free and do not require any payment. In addition, you must write a recapitulative statement.

A pro forma invoice must be created for each tax-free Intra-Community transfer. On the invoice, you are on one side the sender, with your address and VAT identification number from the country of origin, and at the same time, with the address of the fulfillment center abroad and the VAT identification number in the respective country, the recipient. The pro forma invoice must also contain the following information.

If you as a merchant deliver the goods in the country of the fulfillment center, you must declare the reception of the goods as an Intra-Community purchase in the advance VAT return of the respective country. The purchase of the products is subject to the VAT, but the VAT can be refunded immediately through input tax deduction and therefore no payment has to be made.

Above a certain value, as an online shop, you have to submit additional Intrastat declarations that monitor the actual movement of goods between the EU member states.

Quick Fixes: 2020 and its Impact

The Quick Fixes implemented in 2020 were part of a broader reform to modernize and harmonize Value Added Tax (VAT) regulations within the European Union (EU), aiming to reduce tax fraud and streamline intra-EU trade. These changes targeted cross-border transactions and were designed to simplify VAT compliance for businesses involved in EU-wide trade.

Summary

If you have further questions about tax aspects as an online seller, we recommend consulting Taxdoo. Whose software can help automate the process of VAT compliance.

Expanding internationally with an online shop comes with its own set of challenges, particularly around logistics. Cross-border e-commerce presents hurdles such as increased shipping volumes and managing inventory. When shipping volumes grow and product SKUs are kept manageable, storing goods in an international fulfillment center can be a smart strategy. It helps reduce shipping costs and delivery times, providing a competitive edge. Additionally, tax regulations must be carefully considered, especially when storing inventory across different countries within the EU.