Cross-border E-Commerce in Europe - Top Countries in Europe

Table of Content

For the fourth time, CBcommerce.eu has now published its report on the top 16 countries in Europe for cross-border e-commerce - with quite interesting developments. Get a nice overview by reading this concise article.

Status quo of cross-border e-commerce in Europe

The enthusiasm for e-commerce in 2022 is somewhat dampened compared to the previous year due to a weakening market. This is compounded by difficulties in the supply chain and a challenging macroeconomic environment.

Despite facing similar challenges, cross-border e-commerce continued to grow in 2021, both in relative terms compared to domestic e-commerce, and in absolute terms, according to the annual "TOP 16 Countries Cross-Border Europe" report.

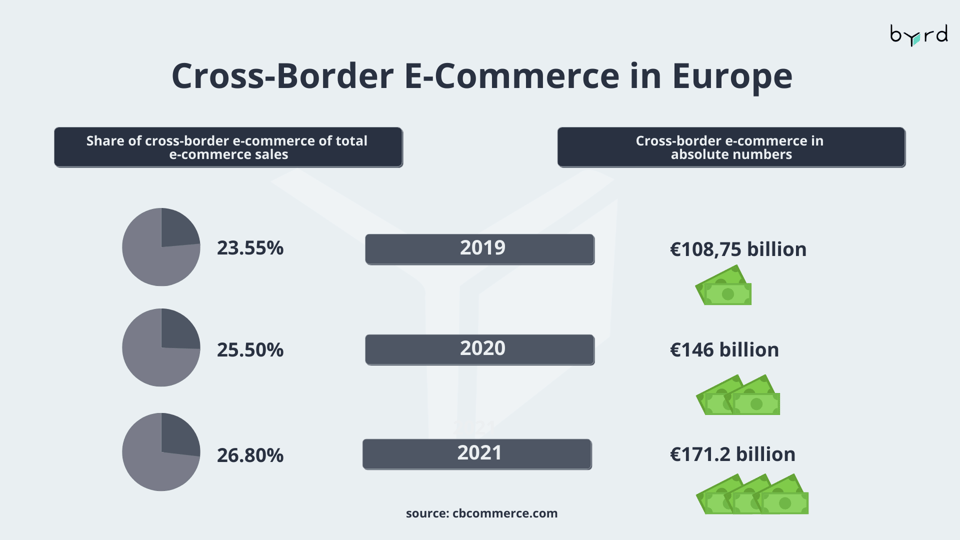

Thus, the share of cross-border online sales within Europe increased from 25.5% (2020) to 26.8% last year. In 2019, the share was only 23.55%.

The scale of this increase can be seen in absolute figures. While in 2019 cross-border sales amounted to €108.75 billion, in 2021 this sum amounts to €171.2 billion, representing an increase of almost 60% in just two years.

Market share of cross-border online trade per country

As in previous years, the top spot in terms of market share of cross-border online commerce versus domestic e-commerce will, unsurprisingly, be held by Luxembourg with 81.8% in 2021. Other top performers are Ireland (69.6%) and Portugal (50%).

Despite a slight increase of 1.2%, Austria (48.3%) slips off the podium for the first time in the last three years. With the biggest jump of all nations within one year (from 29.8% to 43.0%), Sweden takes fifth place, leading a strong field of Scandinavian countries.

As suspected, the nations with the largest e-commerce markets in absolute terms are lagging behind in the relative share of cross-border shipments.

With Spain (29.0%), Germany (26.9%), France (20.4%), and the UK (16.7%), the four countries with the highest sales are within the last 5 places in the relative ranking of cross-border e-commerce versus national e-commerce. Only the Netherlands undercuts this value (15.9%), which is mainly due to the high popularity of Dutch marketplaces such as bol.nl.

Interestingly, while easily explainable, is that only cross-border e-commerce in the UK has shrunk both in absolute and relative terms. The obvious reason for this is Brexit and the resulting increase in complexity regarding cross-border online trade.

The challenges of cross-border e-commerce

From a retailer's point of view, the biggest challenges are high delivery costs, customs clearance, and differing legislation by country.

International customers also see logistical issues as the biggest risk and thus the main reason for not buying from foreign online retailers. The three biggest concerns are:

- Duration of delivery is longer than specified (18%)

- Wrong or damaged products delivered (14%)

- Technical problems (7%)

These values have remained relatively stable in recent years. A marginal reduction in concerns about technical problems (-1% since 2019) and an increase in concerns about the delivery of incorrect and damaged products (+2% since 2019) are the only changes. Concerns about timely delivery have not changed in that time period.

Your chance to profit from cross-border e-commerce

So there is still a lot of untapped potential for online retailers in these areas. But how do you win the trust of skeptical buyers?

As is so often the case, there is unfortunately no silver bullet or simple trick. Expectations must be constantly met. This in turn will lead to good ratings, which builds trust and turns buyers into loyal customers.

In addition, e-commerce companies that can rely on a robust fulfillment setup can also provide guarantees. This also promotes trust, reduces purchase abandonment, and increases conversion rates.

The same is true in terms of reducing concerns on the issue of wrong and damaged products. First of all, trustworthy cooperation with reliable logistics and shipping partners must be ensured. This includes storage, packaging, and shipping.

Again, the key word here is trust; create it by offering easy-to-understand and fair return conditions.

Fulfillment companies like byrd can help you in all these areas. Hundreds of retailers benefit from years of close relationships with parcel services, an international warehouse network, and flexible, scalable, yet customized fulfillment solutions.

In addition, the returns portal simplifies the daily work in your company and the feedback shows that customers appreciate the paperless and transparent process.