VAT Implications with cross-border fulfillment in Europe

Table of Content

If you are in the process of expanding to new markets in Europe, wondering about it, or already have your feet in new territories, you might want to take a look at VAT Implications with cross-border fulfillment in Europe.

In this short Q&A-style blog, we give you the main information regarding tax regulations for cross-border e-commerce fulfillment in Europe. You can also download our VAT-ID one-pager at the end for more information.

What is a VAT-ID?

A VAT-ID, or Value-Added Tax Identification number, is an identifier used by a large majority of countries (including European countries) for value-added tax purposes.

Every country issues its own national VAT-IDs, which means that, in theory, you need a VAT-ID for every country you are doing business in. It begins with the country code and is followed by a unique series of numbers. (i.e. FR123456789)

Why and When Do I need a VAT-ID?

Most companies and entities that have economic activities need a VAT number. The following cases that oblige to register for a VAT-ID are:

- Carrying out the supply of goods or services taxed with VAT

- Making an intra-EU acquisition of goods

- Receiving services for which paying VAT is liable

- Supplying services for which the customer is liable to pay VAT

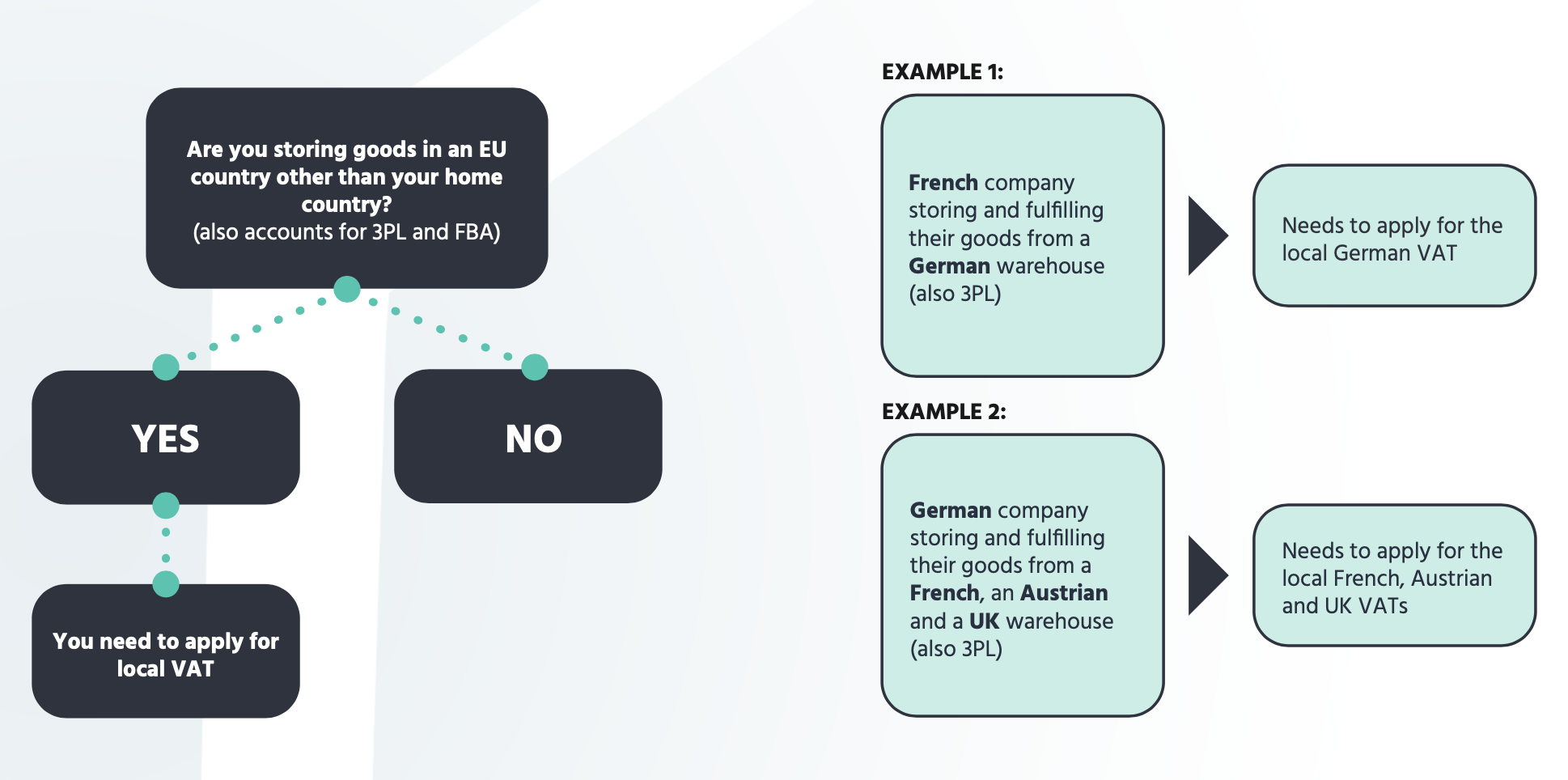

Let’s be a bit more specific in regards to the movement of goods and warehousing

One of the biggest challenges in cross-border storage is the correct classifications of the transactions regarding VAT. What you need to consider is explained in the following.

The transfer of goods to another EU country has no cash flow implications. However, the theory behind it is a bit more complicated. From a VAT perspective, the transfer of goods to the warehouse is divided into the following two transactions:

- Intra-community movements in the country of origin

- Intra-community purchases in the country of destination

Both transactions need to be declared to the respective local tax offices, which means that local VAT registrations are required in the country of the warehouse.

Intra-community movements and Intra-community purchases

|

Intra-community movements For intra-community movements, companies have to declare a so-called intra-community transfer in the country where the transfer starts. The intra-community transfer is in general VAT-exempt. However, since 2020 the VAT exemption is subject to certain conditions such as a valid VAT-ID in the destination country and the respective reporting of the transaction in the EC Sales List. Additionally, a so-called pro forma invoice needs to be issued. A pro forma invoice is an invoice to yourself and is just needed for VAT purposes. |

Intra-community purchases Your goods have arrived in the country where they will be stored. This is called an intra-community purchase. Unlike the intra-community movement, the purchase is not VAT-exempted. This means that the transaction is subject to VAT in the respective country. At the same moment, the retailer has an input VAT deduction. As a result, the VAT burden will still be zero. Nevertheless, due to the declaration of the intra-community purchase, the tax office knows that the goods are now located in the respective country to be further sold later on. In order to be compliant, you need to be VAT registered in the country of the warehouse prior to any goods movements to this country. |

In a nutshell, here are 2 examples:

How do I apply for a local VAT-ID?

In most EU countries you can apply for a VAT-ID by post or online. The deadlines, waiting times, and the detailed process for the VAT registration vary across countries.

First of all, you need to identify the responsible tax office. It is different from one country to another.

Then you need to download, fill out, prepare additional documents and send your registration to the authorities.

Please, download down here of this blog our one-pager to find the whole procedure for VAT-ID application.

Do I Still Need it With the New OSS Regulation?

Earlier, we said: “in theory, you need a VAT-ID for every country you are doing business in.” Since July 1st, 2021, there have been some changes regarding EU VAT law with the implementation of the so-called VAT E-Commerce package and the One-Stop-Shop as its central element.

The main information you need to know here is that the OSS is here to declare B2C cross-border sales. In this case, you won’t need a local VAT-ID.

Please be aware that B2B transactions, national B2C transactions, and the movement of goods cannot be reported through the OSS. In this case, you will need a local VAT-ID.

Are VAT-ID and EORI Numbers The Same?

Short answer: no.

The EORI number only serves customs authorities in import and export matters. The VAT-ID, however, is used for tax purposes and declaration of movements of goods across borders.