Automated cross-border e-commerce processes – The case of international VAT compliance

Table of Content

As an e-commerce merchant, you have probably heard of the new regulations implemented on July 1st, 2021, regarding international VAT compliance. While a lot has been said and written about the biggest EU-VAT reform so far, there is still a lot of confusion among online sellers.

For this reason, we’ll shine a light on the challenges of cross-border sales and fulfillment in terms of taxes. We’ll also explain what the One-Stop-Shop (OSS) is, why it was introduced, and how you can use it. Moreover, we’ll introduce the IOSS (Import One-Stop-Shop), followed by the opportunities coming from automated VAT compliance processes. Finally, we’ll answer relevant questions that were asked during our e-commerce Masterclass Series.

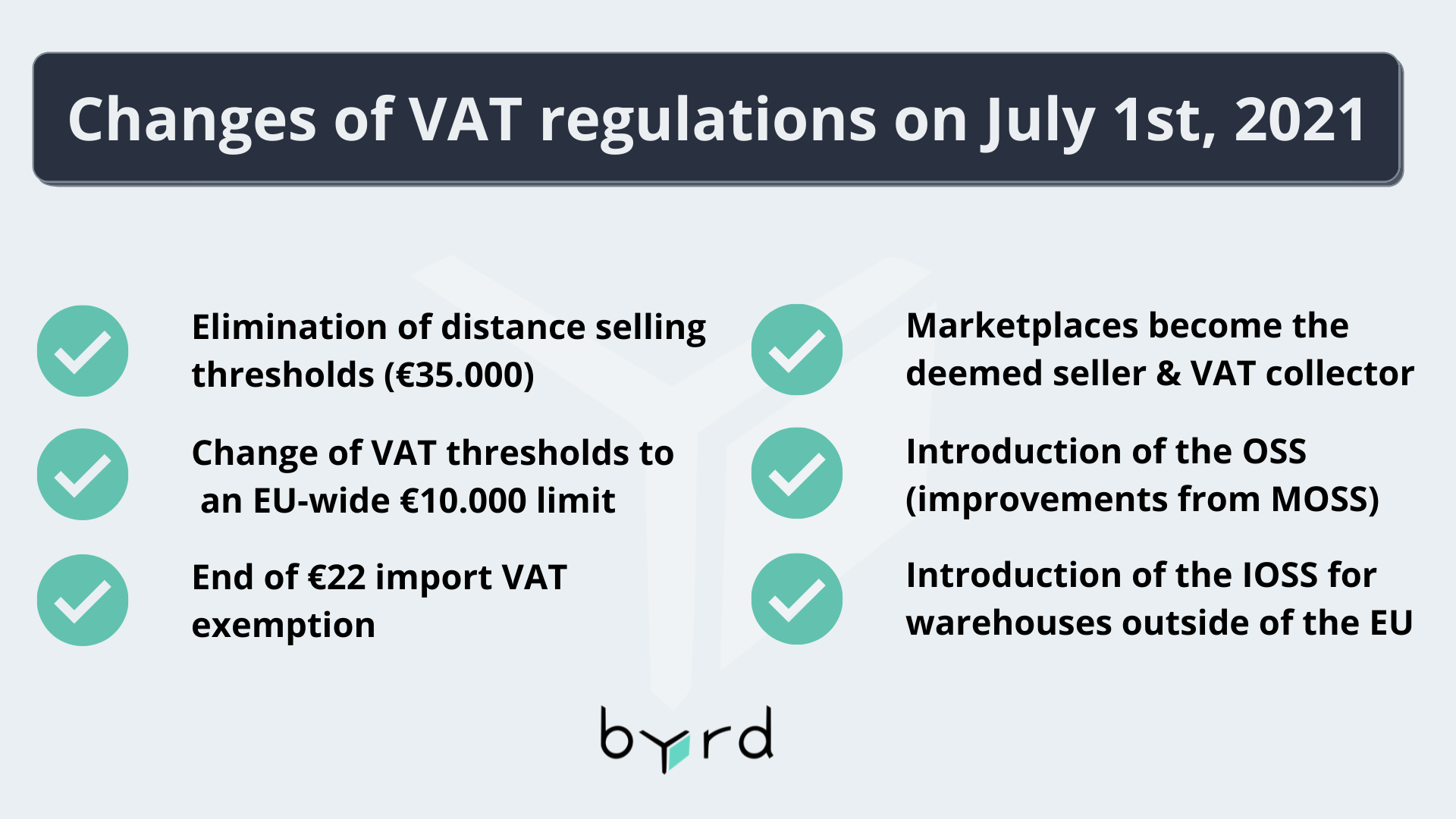

Changes of VAT regulations on July 1st, 2021

Let’s begin with summarizing which VAT regulations have been changed, cut, or introduced at the beginning of Q3 2021:

- Elimination of distance selling thresholds (€35.000)

- Change of VAT threshold to an EU-wide value of €10.000 in total

- End of €22 import VAT exemption

- Marketplaces become the deemed seller and VAT collector

- Introduction of OSS

- Introduction of IOSS

- No more invoice obligation

Before the 1st of July 2021, individual distance selling thresholds amounted to €35.000. Exceeding that threshold with your cross-border sales meant that you became tax liable in the country of destination. Thus, you were required to register for tax and to submit local VAT returns. These distance selling thresholds have been eliminated as of July 1st.

Instead of the distance selling thresholds, an EU-wide VAT threshold of €10.000 has been introduced. These €10.000 are a combined sum of all the cross-border sales within the European Union. Once they are exceeded within a year, you become tax liable in all destination countries as well. This applies also for the following year. Hence, if you once exceed the threshold as a growing company, you’ll probably never go back.

|

Example of EU-wide VAT threshold: If you sell products for €9.990 from Germany to France and then fulfill another order worth €10 or more from the Netherlands to Spain, you exceed the limit and are tax liable for every order fulfilled in Europe. |

Challenges of cross-border sales

Besides understanding the parallel compliance structures (local VAT returns versus OSS) and all of your responsibilities, the biggest challenge is to keep track of your sales. The parallel compliance structures will be explained in more detail below.

In order to do it right, you need to filter between local sales and cross-border sales. In other words, separating what is OSS relevant and what needs to be submitted locally.

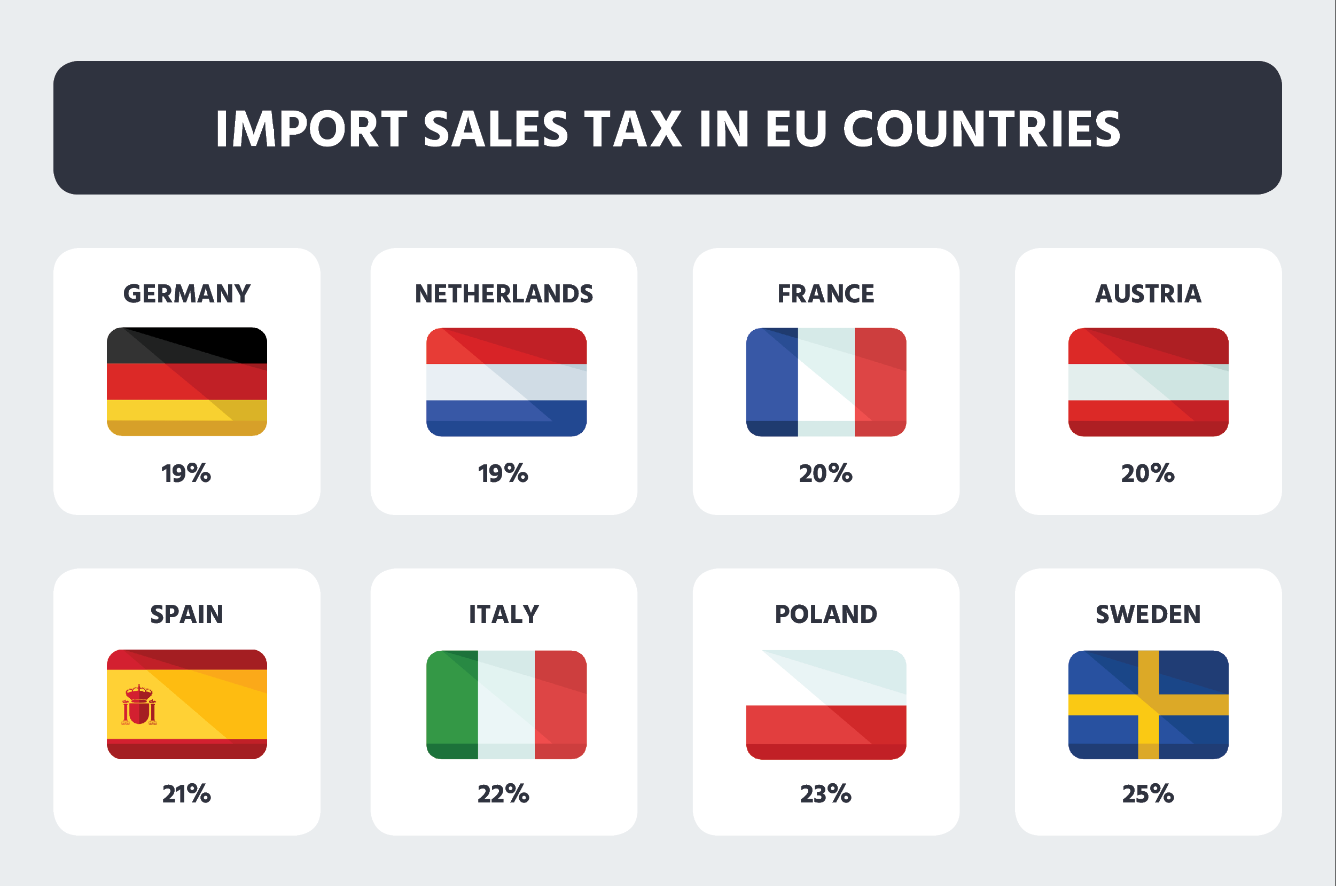

Furthermore, it can be a pain in the OSS (pun intended) to keep track of the correct tax rates for all EU countries (in most countries the rate is around 20%). See a list of a few countries below (as of Q3, 2021).

Challenges of cross-border fulfillment

All your B2C e-commerce sales that cross borders in the EU must be declared via the OSS.

However, for foreign warehouse usage, you are VAT liable locally. That means that you need to submit ongoing VAT returns in the respective countries. These have to include your Intra-community movements, B2B sales, and your local B2C sales. This is not done via the OSS.

To evaluate and filter these transactions automatically, a digital solution is a real game-changer. It is also possible to do this manually, however, when fulfilling a large number of orders, this becomes less feasible in practice. A digital solution will help you to avoid mistakes, declare transactions twice, or even forget to declare your transactions at all.

Benefits of the OSS (One-Stop-Shop)

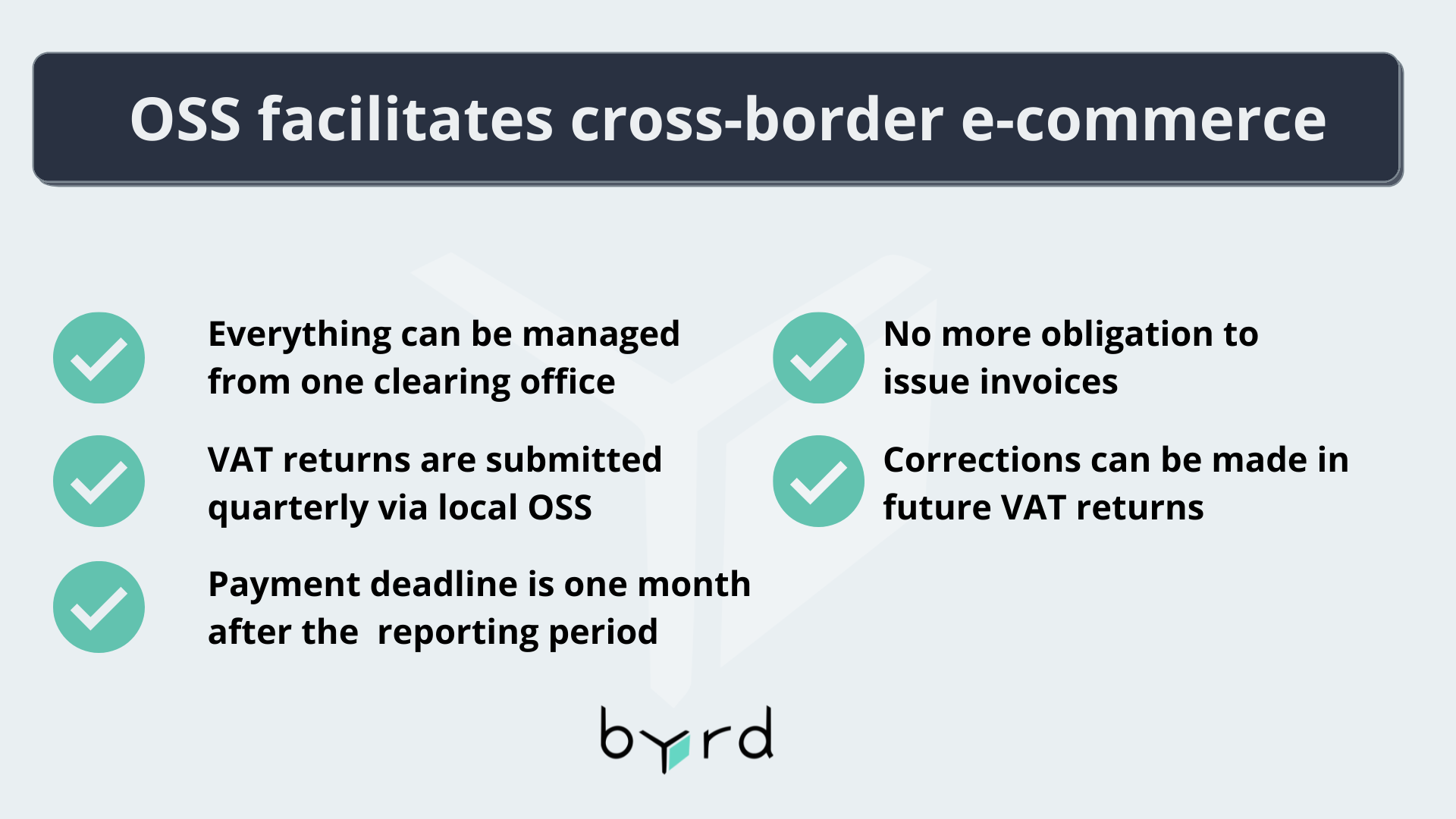

Now, while the VAT reform caused some unrest in the e-commerce community and some new rules seem to complicate business, there are also new processes that facilitate cross-border e-commerce sales. One introduction that simplifies international business is the launch of the One-Stop-Shop (OSS) system.

The most important question is: When do you need the OSS?

The simple answer is: OSS is needed when you exceed the new common threshold (10.000€) and sell in the EU.

Additionally, here is a list of what has become simpler with the introduction of the OSS:

- Everything can be managed from one clearing office

- VAT returns are submitted quarterly via the local OSS

- The payment deadline is one month after the end of the reporting period

- No more obligation to issue invoices

- Corrections can be made within a future VAT return by stating the period that has to be corrected

The most important change clearly is that you can now declare and submit all cross-border sales within the EU centrally to one clearing office in your resident country via the OSS. So you only have to pay one sum and the tax authority will then distribute it to the relevant other European countries. Good news for you – no more bank transfers to numerous EU states for you

Moreover, VAT returns are submitted quarterly. So, you have three months to collect the necessary transaction and sales data. Additionally, the payment deadline is one month after the end of the reporting period.

| Example: You have to submit VAT returns for Q3 (July – September) via the local OSS. The deadline is the 31st of October. Proper planning will make Halloween a bit less spooky. |

Corrections have become a lot easier now. You just have to state the period that has to be corrected and include it in one of the following OSS declarations. Next, you are no longer obliged to issue invoices. Note, however, that you satisfy your customers’ needs. If they still want to get the invoices, you should still provide them. The importance of considering cultural differences should not be underestimated here.

Overall the OSS is a tool that makes cross-border trade simpler and centralized. While you can still refrain from using it and submit your VAt return in each country individually, we can’t see a reason why you should do that.

IOSS: What is that?

IOSS stands for Import-One-Stop-Shop. As an online merchant, you need to make use of the IOSS when you use a warehouse outside of the EU (hence, including Switzerland and UK). In order to get an IOSS number, you’ll need a VAT number (that you already have as an EU seller). If you are a non-EU seller, you’ll need a fiscal representative in an EU country to register for the IOSS. In case you are using a warehouse in the EU, that would ideally be in the country where you first ship your goods to. If that’s not the case, you can choose any EU country.

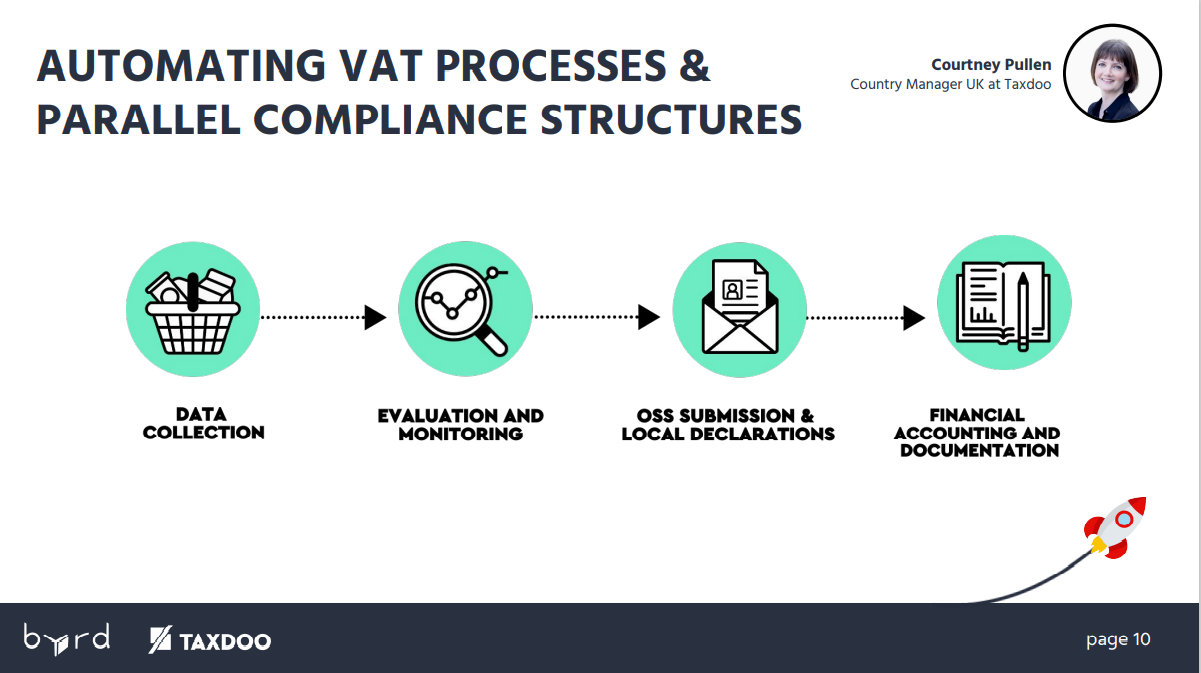

Automating VAT processes & parallel compliance structures

Automation is a key term in e-commerce. This is true for marketing, communication with customers, logistics, and many more areas. It is the same when it comes to VAT processes. While many merchants use the services of 3PL companies like byrd to outsource their order fulfillment, they should consider tax companies like Taxdoo to set up a hassle-free VAT process as well.

This process usually consists of 4 steps:

Data collection

You can integrate your shop with a system like Taxdoo. In that way, all your data can be collected and filtered automatically.

Evaluation and monitoring

Then you can see where exactly your transaction data needs to be declared. It will list where your B2C, B2B, and everything else needs to be declared. It also includes VAT calculations, so that you know exactly how much and where you have to pay.

OSS submission and local declaration

If you exceed the €10.000 threshold and are registered via the OSS. These are important if you are using fulfillment centers in and throughout Europe. Then you are VAT liable and are required to submit these ongoing local declarations. Again, automation is key to operate in the most efficient way possible.

Financial accounting and documentation

Chances are you are working with a tax advisor. Having everything automatically sent to him or her in an organized way will help both you and your tax advisor. So getting everything in a format that can be worked with saves a lot of time. And as Benjamin Franklin said – time is money.

|

It was the first of five webinars in our Masterclass Series covering the topic of peak-time readiness. If you want to learn more about automated cross-border e-commerce processes and international VAT compliance, you can download the webinar presentation here. And to be informed of our next webinars and events, you can subscribe to our newsletter below! |

Webinar Q&A

At the end of this webinar participants (of which 79% indicated to sell or store cross-border) asked interesting questions that were answered by the combined effort of Taxdoo and byrd experts.

Let’s jump right into some of the questions asked.

Question:

Is that €10k limit just for micro-businesses rather than a threshold for all companies?

Answer:

The €10k limit applies to all companies for cross-border B2C Sales of physical goods.

Question:

How is the OSS system applicable to my Amazon sales as I do not know where Amazon is storing my merchandise?

Answer:

In that case, you’d have to manually go to every transaction with Amazon, and create everything by yourself. That includes looking at the warehouse movements and alike. Hence, every intra Amazon movement should be declared. This, however, is not possible via the OSS and has to be done locally. That is a lot of hassle that could be automated and taken care of when working with experts like Taxdoo.

Question:

If our business is neither in the UK nor in the EU, how can I get an IOSS and OSS?

Answer:

You can register for IOSS or OSS in any EU country but depending on where your company is based, you need a fiscal representative to submit the registration.

|

About TaxdooTaxdoo automates the VAT processing of international e-commerce businesses – including the daily monitoring of delivery thresholds. All tax-relevant data is automatically obtained via interfaces to marketplaces (Amazon, eBay, etc.) and ERP systems, analyzed, monitored, and forwarded to a partner network of tax consultants for submission abroad. For more information visit www.taxdoo.com |