EORI Number Guide for E-Commerce Retailers

Table of Content

As an online retailer, you might want to expand your e-commerce business into new markets in Europe at some point. However, expanding to international markets implies selling and, most likely, also storing goods in other countries. This, in turn, will also introduce some customs procedures, such as the EORI number, that you will have to take care of.

To help you out, we prepared a concise FAQ-style guide that covers everything you need to know about the EORI number and how to get it. In addition, we also prepared an informative EORI one-pager that you can download at the end of this blog.

What is the EORI number?

The EORI number, alternatively also known as the EORI code, is a unique identification number for companies that actively operate with customs procedures in the European Union. It stands for Economic Operator Registration and Identification. By getting an EORI number, the company registers as an official economic operator with customs authorities.

The main goal of the identification number is to ensure the security of customs operations. It allows customs to identify those companies during customs and clearance procedures.

It is important to note that the EORI number is mandatory for companies involved in exports and imports or any other operation involving customs procedures (for example, storing goods abroad).

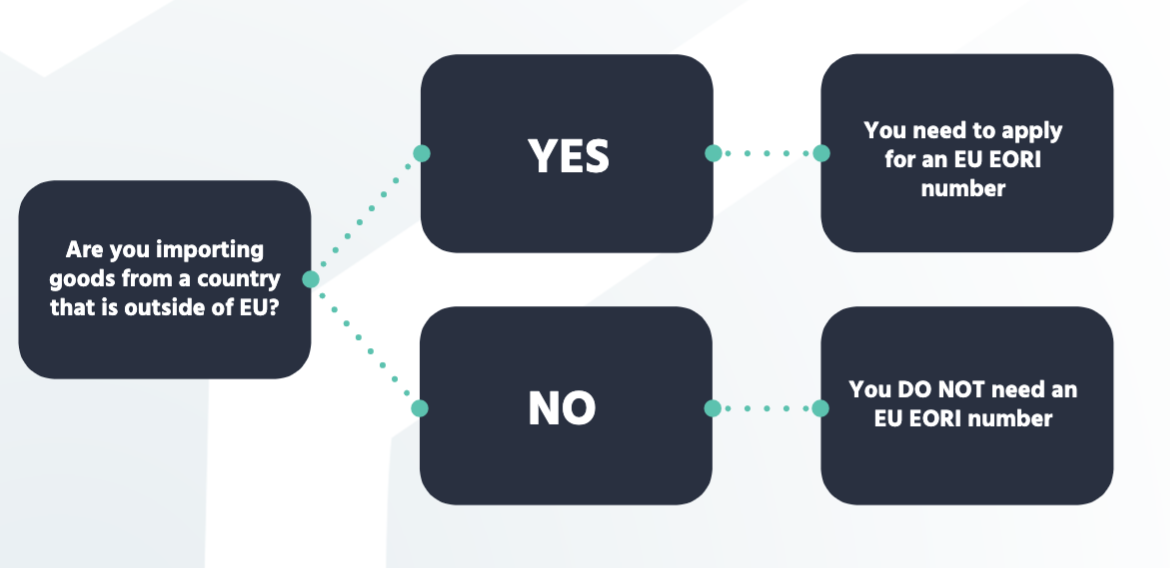

Do I need an EORI number?

The first question you have to ask yourself is: “do I need an EORI number?”. Well, the answer is quite simple:

- If you are importing/exporting goods from/to a country that is outside of the EU → YES

- If you are NOT importing/exporting goods from/to a country that is outside of the EU → NO

In a nutshell, the EU EORI-ID is a must-have for any business that is dealing with customs procedures by importing or exporting goods and serves as a unique identification number. This also means that you need only one single EU EORI-ID for importing goods into the EU, independent of the country within the EU.

Usually, the EORI code will be a combination of a country ID and a unique sequence of numbers. For example, if you are applying for a German EORI code, your code will look like this; DE123456789. Comparably, the French EORI code will look like this; FR123456789.

Please note that UK retailers, who are importing or exporting goods to countries outside of the UK, need a British EORI number (GB123456789).

How can I request an EORI number?

Before requesting an EORI number, please make sure that you don’t already have one. You can check that here.

Moreover, you also need to find the responsible customs authority for your registration. Therefore, if you are:

- a European retailer, request it to your local authorities

- a non-European retailer, request it to the country you want to import your goods first

On this website, you can find an overview of the responsible customs authorities.

Last but not least, it is also worth noting that you have 3 different options for how to request your EORI ID; online, by email, or by post. Then, depending on the country, you’ll have to fill out forms and enclose valid identification documentation. To read more about this procedure, download our one-pager down here.

Are VAT-ID and EORI numbers the same thing?

Short answer: no.

The main difference between VAT-ID and EORI is that VAT-ID is used for tax purposes, whereas the EORI code only serves customs authorities in import and export matters.

Is it needed for cross-border fulfillment and warehousing?

As mentioned above, if you are storing goods in the European Union that are imported from abroad (non-EU countries), you will need an EORI number. This also applies if you do cross-border warehousing or use the services of a 3PL company like byrd. But don’t worry, our team of logistics experts will assist you and make sure your EORI registration process is streamlined and hassle-free so that you can focus on business growth and expansion to new markets.