Secure sufficient stock levels and realize your growth potential

Table of Content

Everyone in business knows – cash is king. E-Commerce is no exception. In fact, cash becomes even more essential in the peak season. The most important online shopping days in e-commerce all fall into the final quartal of the year. Hence, online merchants need to stock up to fulfill the increased demand and avoid stock-outs. This can be a real deal-breaker for growing online companies resulting in cash flow gaps and unhappy customers. In the worst case, this can even result in business failure.

In this article, we’ll shine light on how you can prevent facing these problems including stockouts, inconsistent sales, and stagnant growth. A steady stream of cash in expanding and scaling companies will keep you going.

Limited offer of traditional inventory finance

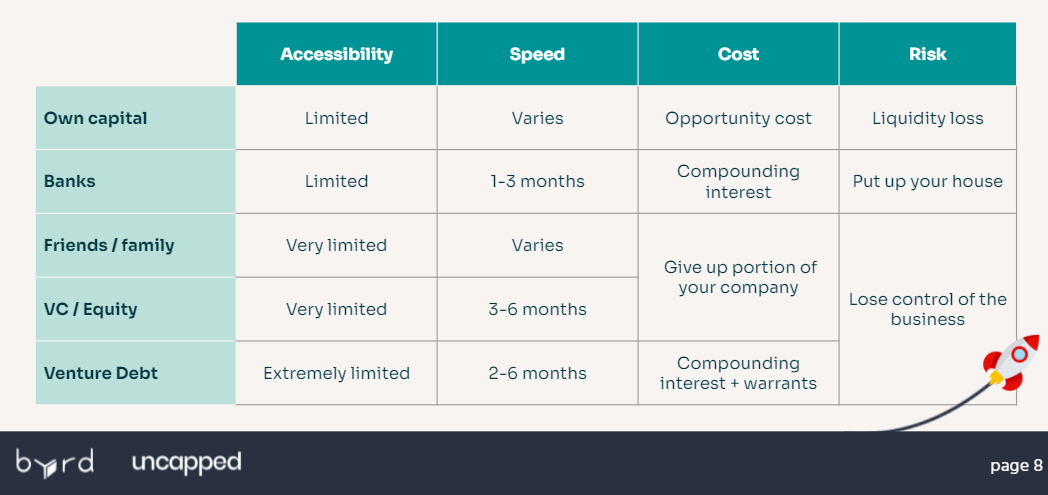

Let’s start by taking a look at what options merchants have to finance their inventory. In general, there are 5 categories of inventory financing for e-commerce businesses.

- Own Capital

- Banks

- Friends/Family

- VC/Equity

- Venture Debt

Naturally, the accessibility of these options varies greatly. If you want to be eligible for bank or equity financing, for example, you will have to meet strict criteria. Using your own capital and sometimes money from friends and family, on the other side, comes with great economic and social pressure. As you can see in the overview below, these different sources of financing additionally vary in the time it takes until the cash is available, the costs that are involved as well as the risk.

Safe alternative – revenue-based finance

A safe method of securing inventory capital, according to the experts of Uncapped, is revenue-based finance (RBF). This method allows businesses to access capital in return for a fixed percentage of their future revenues.

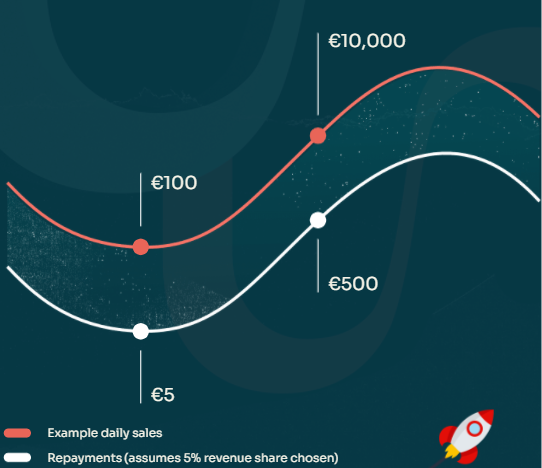

| Here is an example: A company receives €100.000 for a share of 5% of their revenues. This means that for every sale of €100, €5 will be paid back until €100.000 has been paid off. |

If sales slow down, so do the repayments. This way, negative consequences of unforeseeable events like the pandemic or marketing campaigns that do not lead to the expected results, can be attenuated. Consequently, the impact on the cash flow is not as severe as it would be in traditional inventory finance setups.

Advantages of revenue-based finance

By offering RBF, our partner Uncapped allows businesses to move fast. They will check your sales history for the last 6 months and will come to a quick decision within 24 hours. You’ll also be able to access funds within 2 days.

Using their services also allows you to keep control of your business and your finances. No personal guarantees are involved. The deal also does not include any loss of equity or hidden fees. The only charge is a flat fee of 6 – 9.5%, which you’ll have to pay back on top of the returned revenues.

Finally, this inventory financing service allows you to be flexible. If revenues slow, so do repayments. If the business is going well, you can capitalize on opportunities as they arise and top up your funding on the go.

Prepare for peak season in e-commerce

Keeping a positive cash flow is a huge challenge. Unfortunately, there are more business areas that are getting more complicated during the peak season. The good news is, however, with good preparation you can outperform your competition. This is especially true in logistics. To pave the way for a successful Christmas season make sure to:

- Increase your processing capacity requirements: storage space or manpower

- Invest in order processing equipment: packaging, labels, flyers, adhesives, padding, etc. In addition to investment in stock

- Anticipate costs related to reverse logistics: shipping, transport, restocking, or disposal

- Manage the increasing costs of delivery providers

If you are prepared for the peak season with your cash flow as well as with your logistics, your company is on a solid foundation and nothing stands in the way of a successful Christmas season.

|

About UncappedThis blog results of our partnership with Uncapped – materialized in our webinar together on the 28h of September 2021. This was the third of five webinars in our Masterclass Series covering the topic of peak-time readiness. If you want to learn more about inventory financing and in specific revenue-based finance, you can download the webinar presentation here. And to be informed of our next webinars and events, you can subscribe to our newsletter below! |